A higher assessed property value is usually good news for property owners – it means the value of their investment is going up.

COQUITLAM, B.C., Jan. 5, 2023 – A higher assessed property value is usually good news for property owners – it means the value of their investment is going up.

But does a higher assessed value also mean higher property taxes? Not exactly. A common misconception is that an increase in a property’s assessed value will result in a proportionately significant increase in property taxes. BC Assessment has developed a video to help explain how property assessments impact property taxes.

City Budgeting Process

When a city plans its budget for the year, the amount it needs to collect through property taxes is based solely on the cost of the services it plans to provide (e.g. policing, fire, road maintenance, parks services, recreation programs, etc.). Let’s say this amount is $100 million. No matter how much property values go up or down, the City still only needs to collect $100 million to provide its services for the year.

In a separate process, BC Assessment, the provincial agency responsible for determining the value of all properties across the province, assesses the property value based on factors such as its age, location, size, improvements and the value of recent nearby sales. Coquitlam is not responsible for determining property assessments; however, the City is mandated by provincial legislation to tax properties based on their assessed property value.

These two processes come together when municipalities set the tax rates. The tax rate is the calculation that determines each property’s share of the cost to provide City services in that year. For example, if the average assessed value for Residential Class 1 goes up, the tax rate goes down to compensate. The opposite is true if the average assessed value goes down. But in the end, working from the example above, only $100 million is collected through property taxes. For 2023, Coquitlam City Council has not yet considered the budget and its impact on taxes. It is anticipated that this will occur in late February/early March. Once the budget has been adopted, the new tax rates will be set.

How Did Your Assessment Change Compared to the Average?

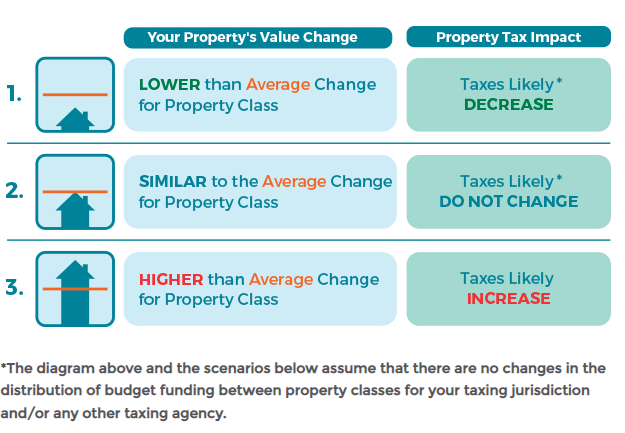

The most important factor is not how much your assessed value has changed, but how much your value has changed relative to the average change in your community.

BC Assessment has developed the following diagram* to help illustrate this concept:

You can find your property class on your assessment notice next to your assessed value. As reported in the BC Assessment Map, for Coquitlam the estimated average property assessment increase for Class 1 Residential is 11 per cent, and for Class 6 Business it’s 20 per cent.

For more information about the relationship between property values and taxes, visit BC Assessment’s webpage at www.bcassessment.ca/propertytax.

For information on property taxes in Coquitlam, visit www.coquitlam.ca/propertytaxes.

Media Contact:

Gorana Cabral

Director, Finance

City of Coquitlam

propertytax@coquitlam.ca

604-927-3050